The SKCP Blog

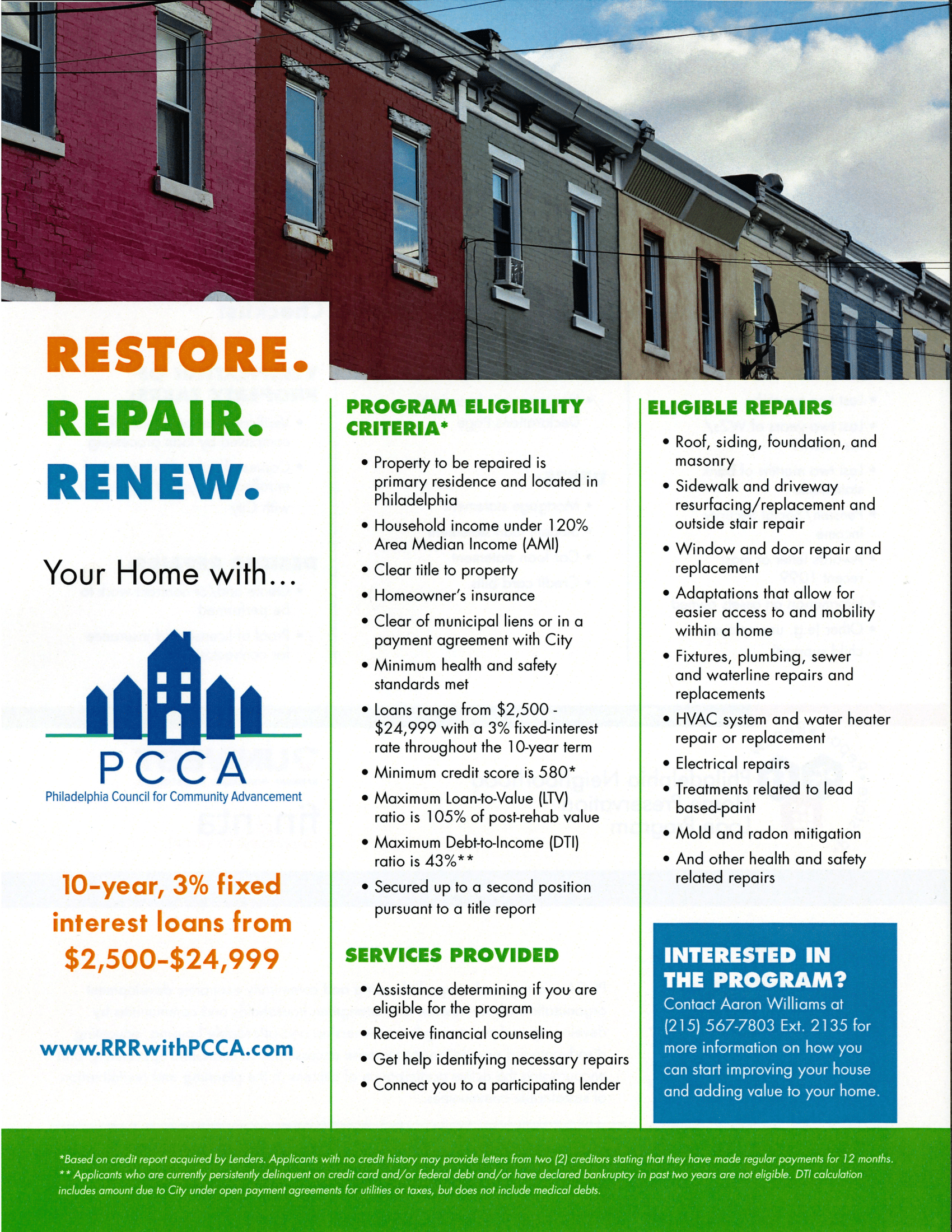

Restore Repair Renew

South Kensington Community Partners

Home Preservation Loan Program

Join Us to Learn More

South Kensington Community Partners

Home Preservation Loan Program Information Session

South Kensington Community Partners

Join us for Tree Planting on Saturday April 27th

South Kensington Community Partners

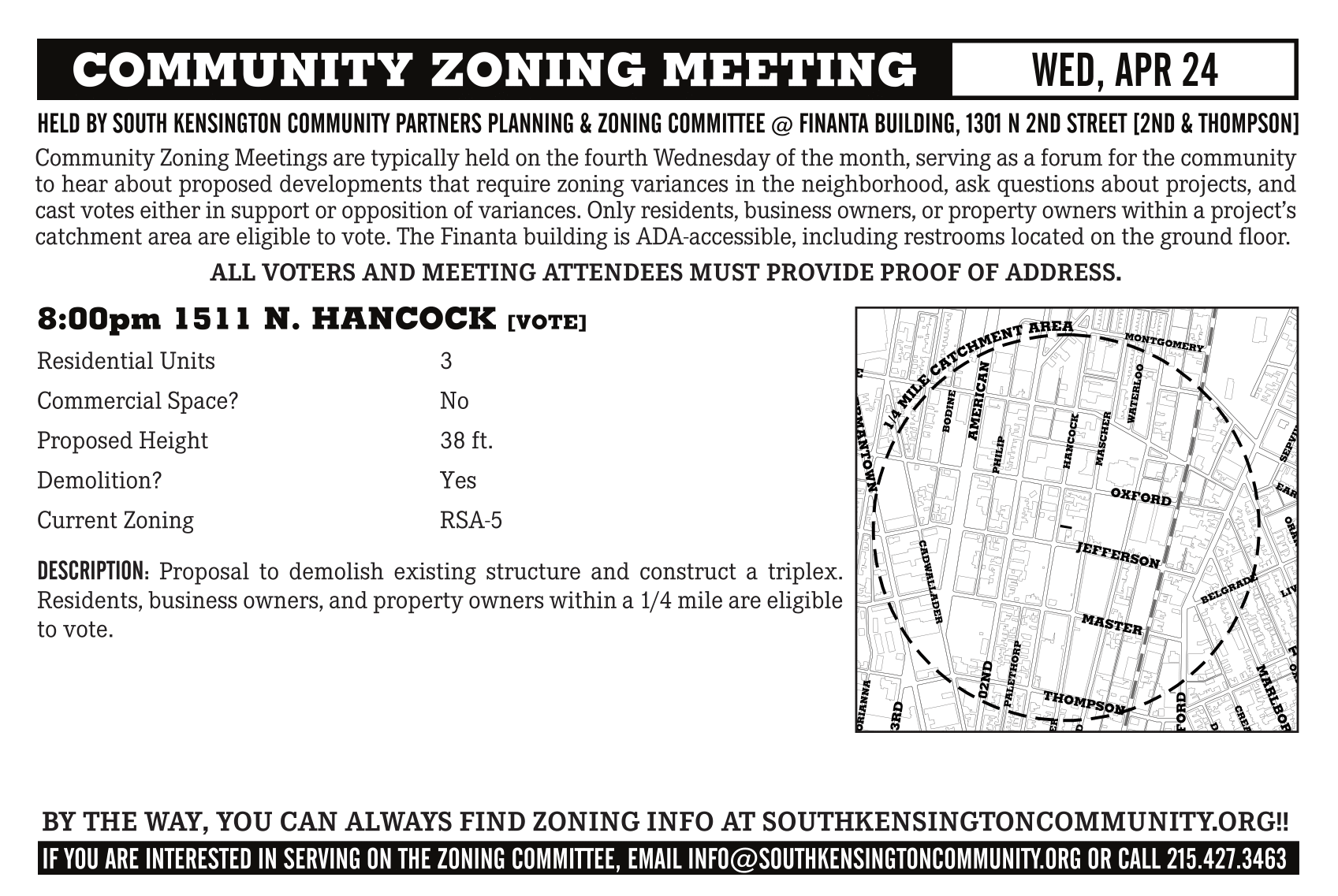

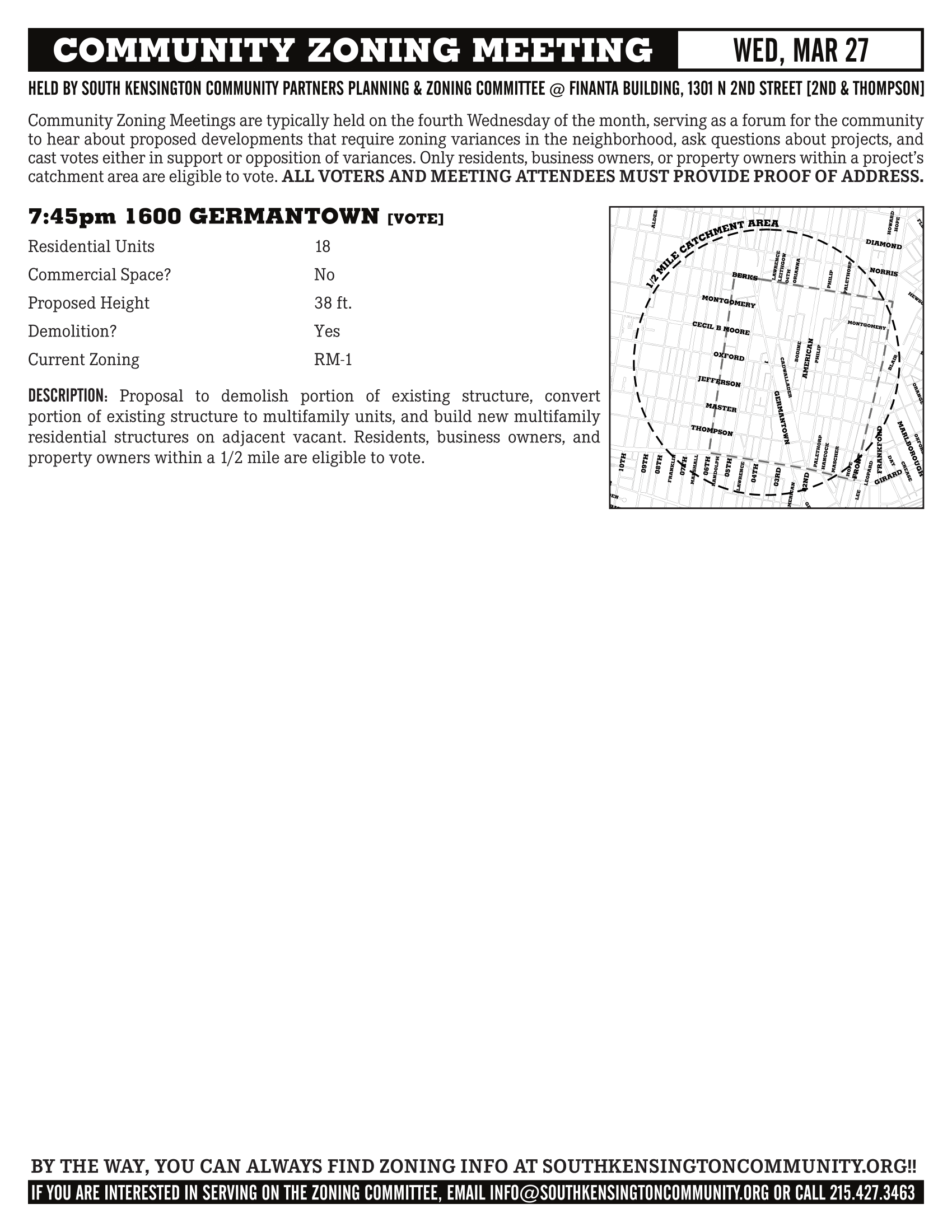

Community Zoning Meeting

South Kensington Community Partners

SEPTA: Upcoming Operating and Capital Budget Public Hearings

South Kensington Community Partners

Free & Affordable Tax Services!

South Kensington Community Partners

Filing your federal and state tax returns can be a complicated process and many people will find that they need assistance. Make sure you’re informed about your options before you visit a tax preparer.

Does it matter where I go to get taxes done? Yes! You may have noticed storefront tax preparers popping up around the city, or that some check-cashers and payday lenders may have started offering these services. However, you should know that these establishments often charge hefty fees directly from your refund – averaging $275 or more, according to recent research – and may not even tell you. Worse yet, some of the least reputable preparers may engage in fraudulent practices that leave you on the hook for unpaid taxes and penalties.

You deserve trustworthy tax preparation services that let you keep every cent of your refund. Fortunately, the Campaign for Working Families provides free tax prep services provided by well-trained volunteers to any individual or household making less than $58,000 per year. Find a free tax prep site near you by visiting https://cwfphilly.org/tax-site-locations/ or calling the SKCP Office. Individuals who are more comfortable in Spanish can reach directly out to Ceiba, a nonprofit organization in Norris Square that specializes in providing asset-building services to the Latino community, at their website http://www.ceibaphiladelphia.org/ or by phone at 215-634-7245.

What is the earned income tax credit (EIC)?

The EIC is an important tax credit that provides a financial boost to low-income individuals and families who worked at any time during the tax year. In 2018, the average amount of EIC received was nearly $2,500. For certain households, the benefit can be as much as $6,341.

The Campaign for Working Families trains volunteers to check for your EIC eligibility. If you go to a different tax preparer, or decide to prepare your own taxes, make sure you check your eligibility for the EIC.

What if I haven’t filed previous years’ taxes?

If you didn’t file your taxes for tax years 2015, 2016, or 2017, you may still be eligible to claim the EIC and get a sizable refund for those prior years.

What is a refund anticipation loan?

Refund anticipation loans (sometimes called refund anticipation checks) are basically high-cost, short term loans that divert your full refund to the lender in exchange for giving you a slightly smaller refund upfront. Even if the tax preparer says the loan has zero interest, there is probably a sizable ($200-$300) origination fee. In addition to gobbling up a chunk of your refund, these loans can be risky if the IRS ends up making corrections to your tax filing that result in a smaller return.

Tax refunds usually take around two weeks to process. Be wary of anyone who tells you that you can “speed up your return” –they’re probably trying to get you to agree to a refund anticipation loan. If you desperately need the money within that two-week window, ask a lot of questions and make sure you understand exactly how much you’re paying in fees.

How can I make the most of my refund?

Many people rely on their tax refunds to pay off debts or make large, important purchases. It’s always a good idea to pay off your highest-interest debt first. If you find you have some of your refund left over, you may want to learn more about Individual Development Accounts, a wealth-building opportunity for low- and moderate-income households that matches savings for the following purposes:

Homeownership: participants receive $2 for every $1 saved (e.g. $2,000 in savings + $4,000 match = $6,000 total)

Higher education: participants receive $3 for every $1 saved (e.g. $1,000 in savings + $3,000 match = $4,000 total)

To learn more, reach out to Clarifi, a Philadelphia-based financial counseling service, at IDA@clarifi.org or 215-563-5665.

What do I do if I owe?

It’s always best to pay the full amount that you owe – or as much as you can afford – by the tax filing deadline (April 15), since interest and penalties will apply to the unpaid balance. If you think that you’ll be able to come up with the money within a month of the deadline, it may make sense to file for a short-term extension and accept the late payment penalty. Otherwise, you may want to set up an installment payment plan with the IRS, or, if eligible, file for a hardship extension or settlement. Find more information about each of these options at https://www.irs.gov/payments.

Thank you Eileen for contributing this piece.

Join Us for the Coming Events

South Kensington Community Partners

SKCP Greening Committee Spring Meeting and City Project Update about Changes on Germantown Avenue