The SKCP Blog

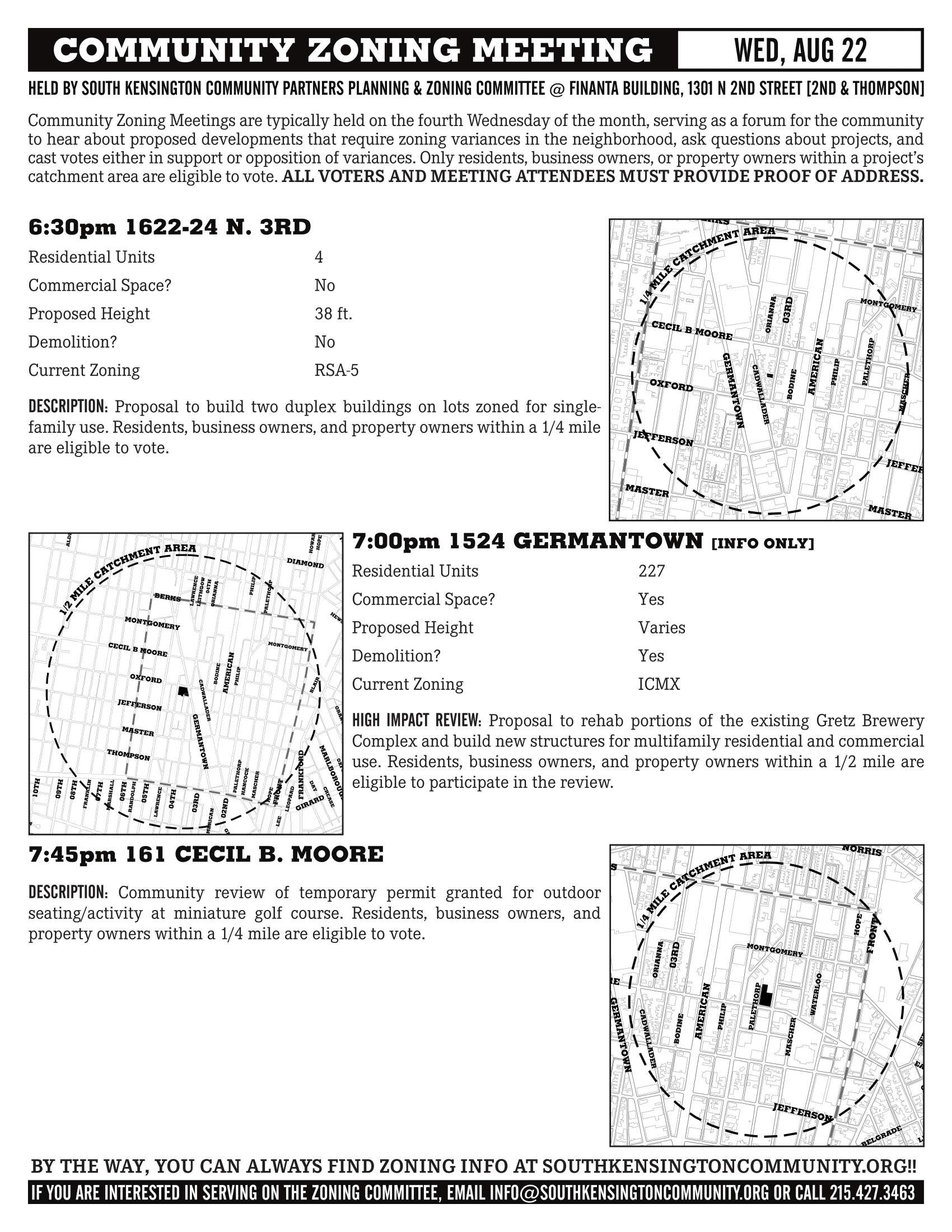

Community Zoning Meeting

South Kensington Community Partners

8/22 meeting outcomes:

1622-24 N 3rd: 1 Yes and 19 No (No Provisos)

161 Cecil B Moore: 6 Yes and 0 No (No Provisos)

1253 Palethorp: 0 Yes and 13 No (No Provisos)

A vote for 1524 Germantown will be held at a future RCO meeting. Check the calendar for upcoming monthly meetings and back here for project details as they are scheduled.

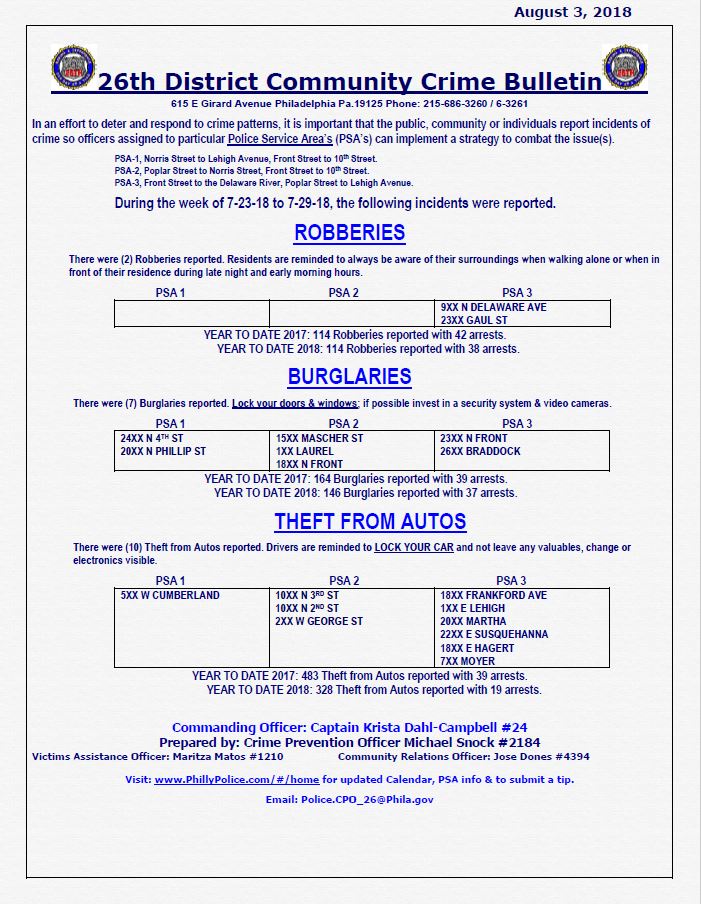

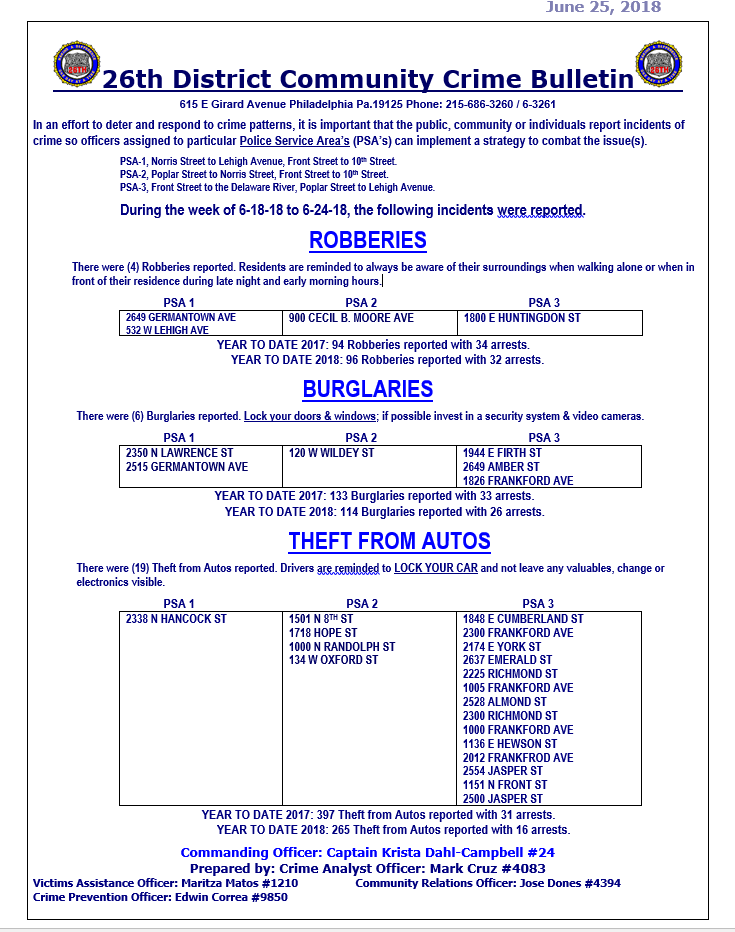

26th District Community Crime Bulletin

South Kensington Community Partners

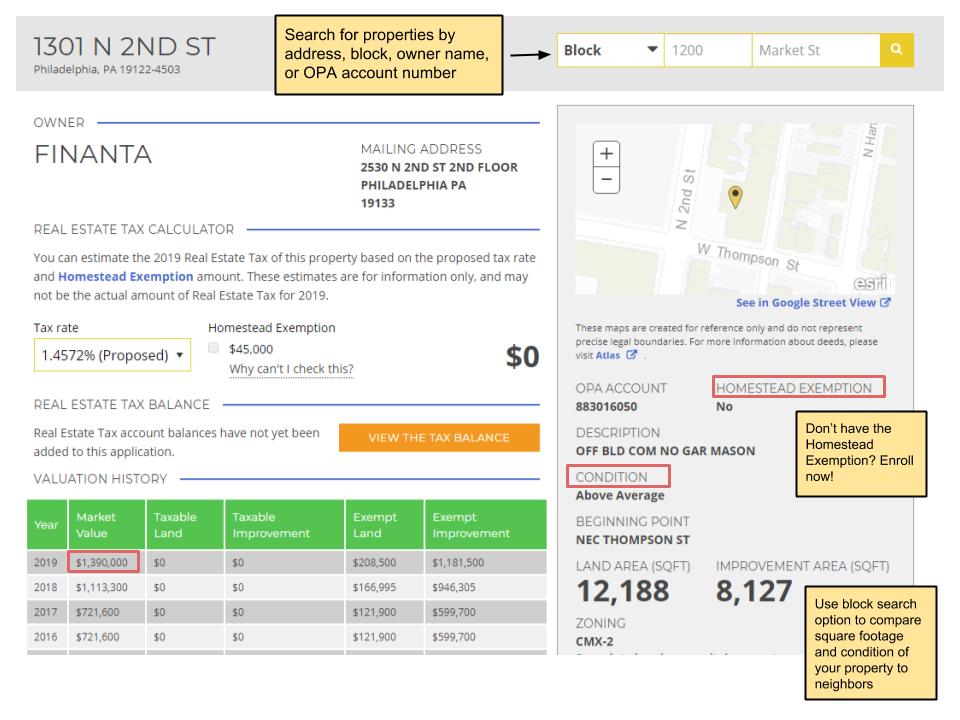

Property Assessment Appeal 101

South Kensington Community Partners

On Monday, August 6, SKCP collaborated with Asociación Puertorriqueños en Marcha and Yorktown CDC to host an info session on the property assessment appeal process.

As many homeowners across North Philadelphia have noticed, property assessments are increasing significantly and this directly impacts property taxes. Please use the OPA website to see your property assessment (and estimate property taxes for next year) if you haven’t already!

Big thanks to our speakers, Salima Cunningham from OPA, Carla Pagan from BRT, and Vicki Riley from Department of Revenue, for joining us, to APM and Yorktown CDC for their collaboration, and to the St. Malachy School for hosting us. Read on for notes from the meeting and links to the forms and programs discussed.

Office of Property Assessment

Salima Cunningham, Communications and Community Outreach Coordinator

According to Ms. Cunningham, the Office of Property Assessment does not collect taxes, and they do not determine the tax rate. Their role is to determine the assessment of properties and this is done through a mass appraisal. Unlike a fee appraisal, this process does not assess properties on an individual basis, but instead uses characteristics such as square footage, condition of the property, amenities, and the surrounding area to assign a value to each property. While this process is efficient for the OPA, it can result in many properties being assessed in a way that owners disagree with. If you do not like or disagree with your property assessment, you can appeal.

There are three levels for a property assessment appeal.

- First Level Review - this is a paper application, mailed with your 2019 assessment. Property owners could fill out this form with the reason for their appeal and return by mail to the Office of Property Assessment by May 25. If you missed that deadline, submitted something but have not received a response, or received response that you disagree with, you can appeal to the Board of Revision Taxes.

- Board of Revision Taxes appeal - this is a formal, legal process where your case will be heard by the Board of Revision Taxes, an independent, seven member board appointed by the Board of Judges of the Philadelphia Common Pleas Court. The Board is required to hear assessment appeals. The deadline to apply for this appeal is Monday, October 1.

- Court of Common Pleas - if you are unhappy with the decision about your property assessment from the Board of Revision Taxes, you can take your case to the Court of Common Pleas.

Board of Revision Taxes

Carla Pagan, Executive Director

Ms. Pagan oversees the Board of Revision Taxes, the independent body that hears appeals and determines updated assessments. The three reasons the Board will hear for an appeal are:

- The estimated market value of your property is too high or too low

- The estimated market value of your property is not uniform with similar surrounding properties

- The characteristics of your property that affect its value are substantially incorrect

Ms. Pagan recommends including as much detail as possible in the appeal form. If your appeal is due to “characteristics of your property that affect its value are substantially incorrect” (such as an assessment indicates you have a three-story house, but you actually have two stories), an evaluator may be able to adjust your assessment on the spot if you describe the situation.

If your increased assessment is due to nearby new construction, your appeal would fall under "the estimated market value of your property is not uniform with similar surrounding properties." Newer buildings will be assessed higher, but if the assessment on your original construction home increases due to this, you can check on other homes similar to yours (age, architecture, neighborhood) to support your appeal. Use the OPA website to see the assessment on properties by address, or to search for an entire block. Properties with a condition that match yours will be especially helpful.

All property assessments are public information. Some helpful points are highlighted on the OPA profile for Finanta, a community development financial institution in the neighborhood and SKCP's landlord (Finanta is a nonprofit so does not pay real estate taxes, but the building is still assessed).

Ms. Pagan recommends you include as much information as possible in your appeal. You can choose between an oral or a nonoral appeal. If you choose nonoral, the information you submit with your appeal form is what the Board of Revision Taxes will base their decision on, and you will receive a letter with your appeal’s outcome. If you choose oral, you will have a hearing scheduled as early as November 2018. Only about half of the property owners who request an oral appeal will have their hearing scheduled before payments are due for 2019. While the Board will consider your appeal either way, you will be able to explain your reasoning and provide further clarification on any of the Board’s questions at an oral hearing.

Be sure to include the assessment you think your property should have received when you submit your appeal. This will be the first question you are asked should you appear before the Board of Revision Taxes. This should reflect the price you would sell your home for if it went on the market tomorrow. If you need assistance determining this and can afford it, you can hire a fee appraiser to privately assess the property. Download the BRT appeal form here, or visit the SKCP office for a printed copy.

Department of Revenue

Vicki Riley, Public Information Officer

Ms. Riley walked attendees through programs from the Department of Revenue that can help homeowners cover property tax payments.

The Longtime Owner Occupant Program (LOOP) is for homeowners who have lived in their homes for at least 10 years and have seen their property taxes triple in one year. Applicants must meet the income guidelines (check if you qualify here) and enrollment in LOOP lasts for 10 years. After the 10 years are up, qualified owners can re-enroll in LOOP, or enroll in Homestead. Apply for LOOP for the 2019 tax year by February 17, 2019.

The Homestead Exemption is the easiest tax assistance program in Philadelphia. Anyone who owns the home they live in qualifies! This program will reduce the amount of your property assessment that you are taxed on by $40,000 (so a property assessed at $150,000 will be taxed on $110,000) and can save homeowners about $550 each year. Check on your OPA account to see if you aren’t already enrolled in Homestead, and then apply here.

The Owner-cccupied Real Estate Tax Payment Agreement program is for homeowners who would like to set up a monthly payment plan for unpaid property taxes. Anyone who owns the house they live in is eligible, and monthly payment amounts are based on income. Click here to see how monthly payments are calculated and here to apply for OOPA.

Other programs to assist homeowners with property tax costs include the Low-income senior citizen Real Estate Tax freeze and Active Duty Tax Credit. Read about these programs on the Department of Revenue’s website to see what the benefits are and if you qualify.

The SKCP NAC office is available has applications or an assessment appeal or any of these tax assistance programs available. Contact Ellie Matthews at 215-427-3463 / ematthews@southkensingtoncommunity.org or visit the office (1301 N 2nd Street) Monday - Friday, 9 - 5:30 to pick up copies or for help with your application. You can also view a video recording of the event on our Facebook page.

FRIENDS OF HART PARK PRESENTS!

South Kensington Community Partners

26th District Community Crime Bulletin

South Kensington Community Partners

26th District Community Crime Bulletin

South Kensington Community Partners

COMMUNITY EVENT REUNION

South Kensington Community Partners

FREE CRIMINAL RECORD REPORT

South Kensington Community Partners

26th District Community Crime Bulletin

South Kensington Community Partners

Keep the Delaware Clean!

South Kensington Community Partners

Meet at Towey Playground

26th District Community Crime Bulletin

South Kensington Community Partners

Community Zoning Meeting

South Kensington Community Partners

7/18 meeting outcomes:

408 Cecil B Moore: 26 Yes and 7 No (No Provisos)

1301 N Howard: 27 Yes and 0 No (No Provisos)

A vote for 1701 N 2nd Street will be held at next month's meeting on Wednesday, August 22.

Goldman's Clinic Meet & Greet

South Kensington Community Partners

Fraudulent Deed Transfers

South Kensington Community Partners

26th District Community Crime Bulletin

South Kensington Community Partners

Solarize Philly: Go Solar at Home

South Kensington Community Partners

26th District Community Crime Bulletin

South Kensington Community Partners

26th District Community Crime Bulletin

South Kensington Community Partners

Greening Committee Meeting

South Kensington Community Partners

Hart Park, 1315 N 4th Street, Thursday June 28th, 6 - 7.30 pm

Join us under the trees at Hart Park to discuss opportunities for new gardening spaces as well as the formation of the Open Space Trust. We have established an enacting board and mission to share with the committee, and are working to recruit board members.

GARDENERS NEEDED:

Catholic Worker House, Orkney and Jefferson: This site has been designated for a future garden, and we are looking for neighbors interested in turning this into a permanent green space for the community.

Cadwallader Green, Cadwallader and Jefferson: There are approximately 7 raised beds available for gardening. we are looking for neighbors interested in gardening in the beds and helping manage this community garden space.

Please contact greening@southkensingtoncommunity.org if you are interested in any of these opportunities and cannot make our meeting, and find more details on the Facebook event here.